All Categories

Featured

Table of Contents

Adolescent insurance coverage gives a minimum of defense and could offer coverage, which could not be readily available at a later date. Quantities provided under such insurance coverage are generally minimal based upon the age of the kid. The present restrictions for minors under the age of 14.5 would certainly be the better of $50,000 or 50% of the amount of life insurance policy active upon the life of the applicant.

Adolescent insurance policy might be sold with a payor benefit rider, which attends to waiving future costs on the kid's plan in the event of the death of the person who pays the costs. Senior life insurance policy, sometimes referred to as rated survivor benefit strategies, offers eligible older applicants with very little whole life insurance coverage without a medical exam.

The allowable concern ages for this sort of protection variety from ages 50 75. The maximum concern quantity of insurance coverage is $25,000. These plans are generally more pricey than a completely underwritten plan if the person qualifies as a conventional danger. This sort of insurance coverage is for a small face amount, generally purchased to pay the burial expenditures of the insured.

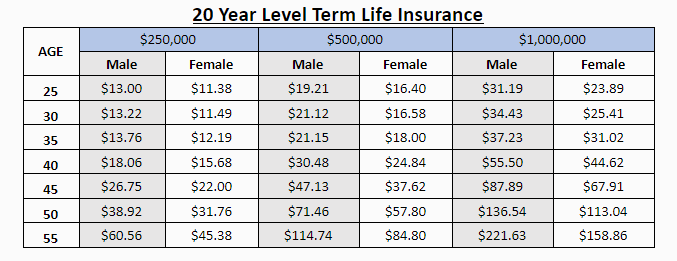

Our term life choices include 10, 15, 20, 25, 30, 35, and 40-year plans. The most preferred kind is level term, meaning your repayment (premium) and payout (fatality advantage) remains degree, or the very same, until the end of the term period. This is one of the most simple of life insurance policy alternatives and needs extremely little upkeep for plan proprietors.

Why do I need Level Term Life Insurance Protection?

You can offer 50% to your spouse and divided the rest among your adult youngsters, a moms and dad, a friend, or also a charity. Level term life insurance for families. * In some circumstances the fatality benefit may not be tax-free, discover when life insurance coverage is taxed

1Term life insurance offers short-lived security for an essential duration of time and is usually more economical than long-term life insurance policy. 2Term conversion standards and restrictions, such as timing, may apply; as an example, there may be a ten-year conversion advantage for some items and a five-year conversion benefit for others.

3Rider Insured's Paid-Up Insurance Acquisition Alternative in New York. There is a price to exercise this rider. Not all taking part policy proprietors are eligible for dividends.

What are the top Level Term Life Insurance Benefits providers in my area?

We might be compensated if you click this ad. Advertisement Degree term life insurance is a policy that gives the same survivor benefit at any point in the term. Whether you pass away on the very same day you obtain a plan or the last, your beneficiaries will certainly get the exact same payment.

Which one you choose depends upon your needs and whether the insurer will certainly approve it. Plans can also last up until defined ages, which most of the times are 65. Due to the numerous terms it supplies, level life insurance policy offers potential insurance holders with versatile options. Beyond this surface-level details, having a higher understanding of what these strategies involve will certainly assist guarantee you purchase a policy that satisfies your needs.

Be mindful that the term you choose will influence the premiums you pay for the plan. A 10-year degree term life insurance coverage policy will set you back much less than a 30-year policy since there's much less possibility of an event while the strategy is active. Reduced threat for the insurer corresponds to lower costs for the policyholder.

Who provides the best Level Term Life Insurance Companies?

Your family members's age must additionally affect your plan term choice. If you have kids, a longer term makes good sense since it safeguards them for a longer time. If your youngsters are near their adult years and will certainly be monetarily independent in the close to future, a much shorter term could be a much better fit for you than a prolonged one.

When contrasting whole life insurance coverage vs. term life insurance policy, it deserves keeping in mind that the last usually prices less than the previous. The outcome is a lot more coverage with lower premiums, giving the very best of both globes if you require a significant quantity of insurance coverage however can not pay for a more pricey policy.

What does a basic Level Term Life Insurance Protection plan include?

A degree death benefit for a term policy generally pays out as a lump sum. Some degree term life insurance policy companies allow fixed-period settlements.

Passion settlements received from life insurance policy policies are taken into consideration income and go through tax. When your degree term life policy ends, a couple of different points can happen. Some insurance coverage ends promptly with no option for revival. In other circumstances, you can pay to prolong the strategy past its original date or convert it right into a long-term plan.

The disadvantage is that your renewable degree term life insurance policy will come with higher costs after its preliminary expiry. We might be compensated if you click this advertisement.

Level Term Life Insurance Companies

Life insurance business have a formula for computing risk using mortality and rate of interest. Insurers have hundreds of customers securing term life plans at the same time and utilize the premiums from its energetic plans to pay enduring beneficiaries of various other plans. These business use mortality tables to approximate the number of individuals within a specific group will file fatality claims each year, which details is made use of to establish typical life expectancies for prospective insurance holders.

In addition, insurer can invest the cash they receive from costs and raise their revenue. Because a level term policy doesn't have cash money value, as an insurance holder, you can not invest these funds and they do not give retirement earnings for you as they can with entire life insurance policy policies. The insurance policy business can spend the cash and earn returns.

The adhering to area information the benefits and drawbacks of level term life insurance policy. Predictable costs and life insurance policy protection Streamlined policy structure Prospective for conversion to long-term life insurance policy Minimal coverage duration No cash value buildup Life insurance costs can enhance after the term You'll discover clear advantages when comparing level term life insurance policy to various other insurance policy kinds.

Is Level Term Life Insurance Premiums worth it?

From the minute you take out a policy, your costs will never change, aiding you intend financially. Your coverage won't vary either, making these plans effective for estate preparation.

If you go this route, your costs will certainly raise however it's constantly great to have some versatility if you desire to maintain an active life insurance plan. Renewable degree term life insurance is another choice worth thinking about. These policies enable you to maintain your present plan after expiry, providing versatility in the future.

Latest Posts

Burial Insurance Review

Funeral Cover Companies

Life Insurance Quotes Free Instant