All Categories

Featured

Table of Contents

- – What is included in Level Term Life Insurance ...

- – What types of Tax Benefits Of Level Term Life ...

- – What is the best Fixed Rate Term Life Insuran...

- – What happens if I don’t have Fixed Rate Term ...

- – Why is Affordable Level Term Life Insurance ...

- – What is the most popular Tax Benefits Of Lev...

Term life insurance is a type of plan that lasts a particular size of time, called the term. You select the size of the plan term when you first take out your life insurance.

Pick your term and your amount of cover. Select the plan that's right for you., you understand your premiums will certainly remain the exact same throughout the term of the policy.

What is included in Level Term Life Insurance Policy Options coverage?

Life insurance covers most scenarios of fatality, but there will certainly be some exemptions in the terms of the plan - Level term life insurance for families.

After this, the policy ends and the making it through partner is no much longer covered. Joint plans are usually more budget friendly than single life insurance coverage policies.

This safeguards the investing in power of your cover quantity versus inflationLife cover is an excellent thing to have because it supplies monetary protection for your dependents if the worst occurs and you pass away. Your enjoyed ones can additionally use your life insurance policy payment to pay for your funeral service. Whatever they choose to do, it's excellent peace of mind for you.

Nevertheless, degree term cover is wonderful for fulfilling day-to-day living costs such as house expenses. You can also utilize your life insurance benefit to cover your interest-only home loan, repayment mortgage, institution fees or any type of various other financial debts or ongoing repayments. On the various other hand, there are some drawbacks to degree cover, compared to other sorts of life policy.

What types of Tax Benefits Of Level Term Life Insurance are available?

Words "level" in the expression "degree term insurance coverage" implies that this type of insurance policy has a fixed premium and face amount (survivor benefit) throughout the life of the policy. Merely put, when people chat about term life insurance coverage, they typically refer to degree term life insurance. For the majority of people, it is the most basic and most inexpensive selection of all life insurance coverage types.

Words "term" here describes a given number of years throughout which the level term life insurance policy stays active. Level term life insurance policy is among the most prominent life insurance policies that life insurance policy suppliers provide to their customers as a result of its simpleness and cost. It is additionally very easy to compare degree term life insurance policy quotes and get the very best costs.

The system is as complies with: To start with, select a policy, survivor benefit quantity and policy period (or term length). Second of all, pick to pay on either a month-to-month or annual basis. If your early death takes place within the life of the policy, your life insurer will pay a round figure of fatality benefit to your fixed recipients.

What is the best Fixed Rate Term Life Insurance option?

Your degree term life insurance plan ends once you come to the end of your policy's term. Option B: Purchase a brand-new degree term life insurance coverage policy.

FOR FINANCIAL PROFESSIONALS We have actually developed to supply you with the very best online experience. Your current web browser may restrict that experience. You may be making use of an old browser that's in need of support, or settings within your internet browser that are not compatible with our website. Please save on your own some frustration, and update your web browser in order to view our website.

What happens if I don’t have Fixed Rate Term Life Insurance?

Already utilizing an updated web browser and still having difficulty? Your current internet browser: Discovering ...

If the policy expires plan your prior to or you live beyond the past termPlan there is no payout. You might be able to restore a term plan at expiration, but the costs will be recalculated based on your age at the time of renewal.

As you can see, the exact same 30-year-old healthy man would certainly pay approximately $282 a month. At 50, he 'd pay $571. Whole Life Insurance Policy Fees 30 $282 $247 40 $382 $352 50 $571 $498 60 $887 $782 Source: Quotacy. Quotes are for a $500,000 long-term life insurance policy plan, for men and females in exceptional health.

Why is Affordable Level Term Life Insurance important?

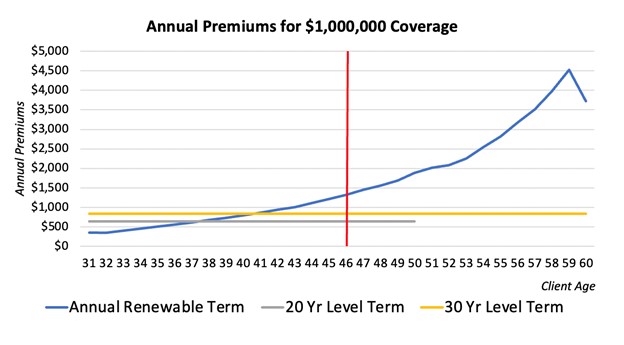

That decreases the overall threat to the insurance firm contrasted to a long-term life policy. The minimized threat is one aspect that allows insurance providers to bill reduced costs. Rate of interest, the financials of the insurance provider, and state regulations can likewise influence costs. In general, firms frequently offer better prices at the "breakpoint" protection degrees of $100,000, $250,000, $500,000, and $1,000,000.

Examine our referrals for the ideal term life insurance policies when you prepare to get. Thirty-year-old George intends to shield his family members in the not likely occasion of his very early fatality. He purchases a 10-year, $500,000 term life insurance plan with a costs of $50 each month. If George dies within the 10-year term, the plan will certainly pay George's beneficiary $500,000.

If he lives and restores the plan after one decade, the premiums will certainly be more than his first policy because they will certainly be based upon his current age of 40 as opposed to 30. 20-year level term life insurance. If George is detected with an incurable ailment during the very first plan term, he most likely will not be qualified to renew the plan when it expires

There are a number of types of term life insurance policy. The ideal option will depend on your individual circumstances. A lot of term life insurance policy has a level costs, and it's the type we have actually been referring to in many of this write-up.

What is the most popular Tax Benefits Of Level Term Life Insurance plan in 2024?

They may be an excellent alternative for somebody that requires momentary insurance coverage. The policyholder pays a taken care of, level costs for the duration of the plan.

Table of Contents

- – What is included in Level Term Life Insurance ...

- – What types of Tax Benefits Of Level Term Life ...

- – What is the best Fixed Rate Term Life Insuran...

- – What happens if I don’t have Fixed Rate Term ...

- – Why is Affordable Level Term Life Insurance ...

- – What is the most popular Tax Benefits Of Lev...

Latest Posts

Burial Insurance Review

Funeral Cover Companies

Life Insurance Quotes Free Instant

More

Latest Posts

Burial Insurance Review

Funeral Cover Companies

Life Insurance Quotes Free Instant